Centering product and brand strategy through customer insight

When a beloved Brooklyn ceramics studio changed ownership, its new leader faced a tough challenge: how to grow e-commerce sales and develop new product lines—without losing the brand’s soul.

I was brought on as a design research consultant to lead a scrappy, insight-driven project: uncover what loyal customers truly valued, identify high-potential product opportunities, and translate messy business questions into clear, confident strategy.

Through end-to-end research—from stakeholder alignment to participant recruitment to a hands-on workshop—I helped Noble Plateware reimagine their future through the eyes of their most dedicated customers.

ROLE

Lead design researcher

Responsible for qualitative and quantitative research, workshop design and facilitation, data analysis, strategic recommendations

DURATION

4 weeks

TOOLS

FigJam, Google Forms, Shopify CMS, Otter.ai

COLLABORATORS

Stiliani Moulinos: Owner, Noble Plateware

Arshlavi Auleear: Photographer

BACKGROUND

Noble Plateware is a small ceramics studio in Brooklyn with a decades-long legacy of handcrafted dinnerware. After the passing of its founder, the company was purchased by a former apprentice, who now faced the challenge of running a legacy business with unclear product strategy, limited data, and a growing e-commerce channel she didn’t fully understand.

-

Understand how to grow e-commerce sales without losing the brand’s identity

-

Identify which product categories (beyond dinnerware) have the highest potential

BUSINESS GOALS

-

Complex user base and sales channels → medley of restaurants, online buyers, local fans, class takers, and associated marketplaces

-

Opaque analytics → Shopify data was not comprehensive enough to produce insights on product prioritization

CHALLENGES

RESEARCH STRATEGY

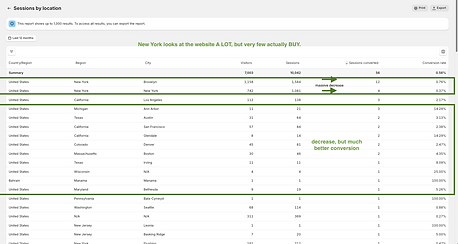

To move Noble’s business forward, we needed to define who its core customers really were. One of the company’s key goals was to grow e-commerce sales, so our insights had to focus on the online segment. I began with a high-level Shopify analysis and found a key signal: New York customers brought in the most revenue but had one of the lowest conversion rates—a clear opportunity.

Combined with Noble’s strong local visibility, this led to a focused research target: repeat online buyers based in New York with long-term brand familiarity. That profile shaped both our screener and participant recruitment.

RESEARCH GOAL

Clarify Noble’s value proposition through the lens of its highest-potential e-commerce segment:

repeat online buyers in New York with long-term brand familiarity.

SUBORDINATE GOALS

Understand who Noble’s core customers are and how they shop

Define the emotional and functional qualities that make Noble distinct from competitors

Identify which non-dinnerware product categories feel desirable and “on-brand”

WORKSHOP DESIGN

I designed a two-hour in-person workshop to uncover both brand perception and product direction from a small group of screened customers. Activities balanced qualitative insight with practical data to support decision-making across marketing and product development.

I recruited all participants myself, using Shopify sales records, additional screener forms, and email and phone communications. I also facilitated the session solo, designing the activities, preparing all materials, and coordinating logistics on site.

ACTIVITIES

1. Intro Icebreaker

Brief discovery form disguised as a warm-up, which participants shared verbally in a round-table format.

Purpose: Collect foundational marketing insights while establishing rapport.

2. Desirability Mapping

Participants selected adjectives that best described Noble’s products.

Purpose: Reveal the emotional and sensory qualities customers associate with the brand.

3. Personal Inventories

Participants drew maps of their homes and the ceramics in them, then walked the group through their drawings.

Purpose: Understand Noble’s place within broader consumption habits and identify product line gaps.

4. Product Affinity Sorting

Participants arranged product cards along a “most vs least Noble” axis, adding stickers for owned or desired items.

Purpose: Test potential product directions and clarify what feels core to the brand.

KEY INSIGHTS

BRAND PERCEPTION

-

Described as effortless, elevated, satisfying weight, textured, and calming

-

Products have the ability to make food look better and feel better to serve

-

Bright or highly decorative styles were viewed as inconsistent with the brand

PRODUCT HABITS AND PREFERENCES

-

Owned a mix of Noble products, artisan ceramics, and mass-market items

-

Ceramics were chosen for daily use, not display, and functionality and feel mattered

-

Favored versatile pieces that were sensory-rich, even if used infrequently

CATEGORY OPPORTUNITIES

-

Desired additions: small bowls, planters, vases, spoon rests, catchalls, tea sets, and pet bowls

-

No interest expressed in: ceramic lamps, earrings, tiles, or mirrors

-

“Most Noble” items were typically kitchen-adjacent, textural, and modest in shape

STRATEGIC RECOMMENDATIONS

I translated workshop insights into clear recommendations across product, brand, and marketing strategy. These were grounded in customer language and behaviors, and delivered in a report that Noble’s leadership could act on immediately.

PRODUCT DIRECTION

-

Prioritize versatile, kitchen-adjacent products that feel tactile, textural, and multipurpose

-

Avoid expanding into unrelated categories like lamps, earrings, or decorative tiles without rebranding or targeting a different audience

-

Use customer vocabulary to evaluate new product lines: if it doesn’t feel “effortless”, "elegant", or "textural", reconsider

-

Anchor Noble’s identity in understated elegance and effortless craft

-

Prioritize tactile bottoms, evocative glazes, and generous wax lines—the details customers spoke about the most

-

Avoid glazes or forms that read as “bright,” “fun,” or overly decorative—these dilute the brand perception

BRAND POSITIONING

-

Improve online discovery for restaurant customers who may have seen Noble products in use but can’t find them online

-

Invest in paid search ads targeting brand-adjacent terms (e.g. “Noble bowl,” “ceramics from [restaurant name]”)

-

Encourage word-of-mouth marketing from local fans and studio sale attendees through refer-a-friend strategies

E-COMMERCE STRATEGY

OUTCOMES & REFLECTION

This project taught me how much can be uncovered through thoughtful, well-scoped research—even with a small sample and limited resources. The insights from the workshop were delivered as a formal report. While I have not yet heard how the client implemented them, I believe the work provided a strong foundation for future decision-making. Along the way, I also took away a few lessons that continue to shape how I approach research:

TAKEAWAYS

NEXT STEPS

1. Encouraging participants to disagree is surprisingly challenging. Designing activities to prevent groupthink is key.

2. What I love about design research is that it’s both mind-expanding and heartwarming. This may be why I find it so energizing.

3. Feedback needs to be built into the workshop itself or it won’t happen. Next time, I’ll plan a moment for it.

1. Follow up with the client to learn how the recommendations were used and what support would help them move forward.

2. Explore best practices for helping small clients act on strategic research when extended support isn't possible.